Table of Contents

How do you calculate APY (Annual Percentage Yield)?

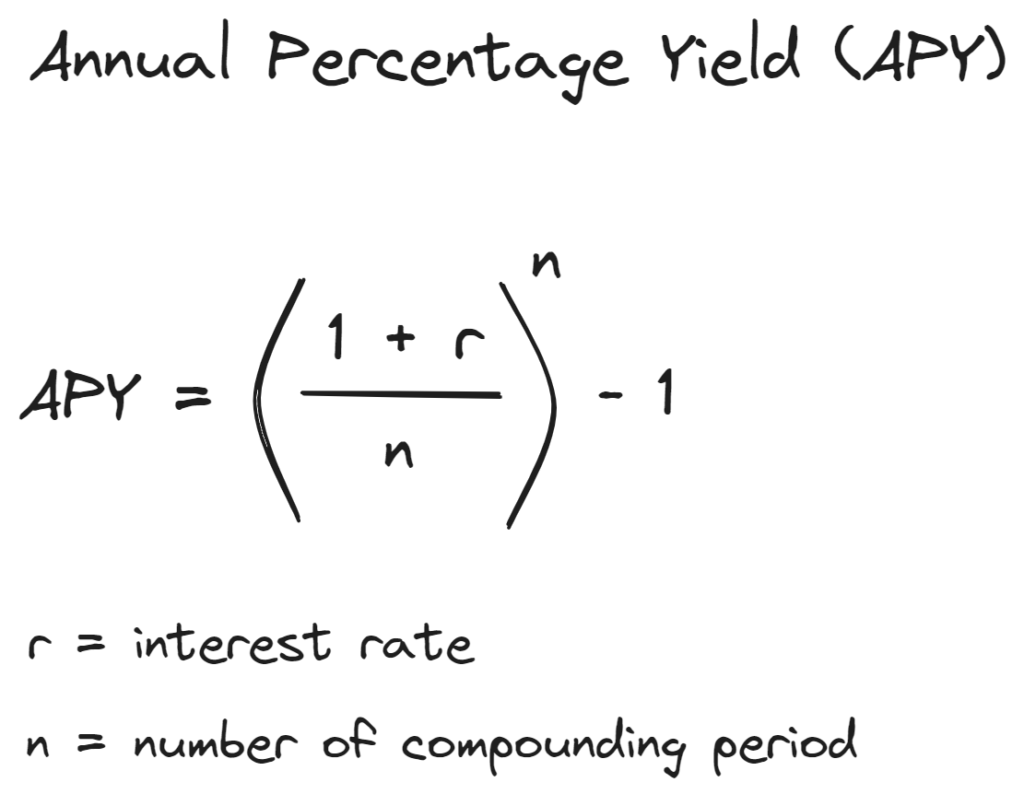

Formula of APY:

The formula for calculating APY is APY = (1 + r/n)^n – 1, where:

Where,

- r is the interest rate,

- n is the number of times per annum that the interest is compounded.

Example: Let’s take an example to better understand APY calculation. Assume an investment with an interest rate of 10% per annum, compounded monthly (n = 12).

APY = [1+(0.10/12)]12 - 1

APY =[1+(0.0083)]12 - 1

APY =1.1047 - 1

APY = 0.1047

APY = 0.1047*100%

APY = 10.47% (rounded to 10.5%)

Difference between APR & APY

APR and APY are two ways to calculate interest on investments, but they represent different aspects of interest calculations. APR, or Annual Percentage Rate, considers simple interest on the principal amount, while APY, or Annual Percentage Yield, takes into account the compounding effect – the interest on previously earned interest. Let’s explore this difference with an example:

To better comprehend the distinction between APR and APY, consider this example: You deposit $50,000 in a bank, and the bank offers an annual interest rate of 1%. The APR will simply yield $500 in interest over the year. However, with APY, the interest is compounded and recalculated regularly. In this example, monthly.

In January, you would earn 1% of the annual interest divided by 12 since it is compounding monthly, which amounts to $41.7. In February, you earn interest on your new balance of $50,041.7. The APY allows you to earn interest not just on your principal but also on the interest accumulated each month.

APY’s compounding effect gradually grows over time, making it a more powerful tool for long-term investments. Understanding the difference between APR and APY is crucial for making informed financial decisions and optimizing your investment strategies.

How to convert APR to APY?

To convert APR into APY, we can use the formula mentioned above i.e. APY = (1 + r/n)^n – 1

In this formula r represents APR which is also called nominal interest rate, n represents number of compounding periods per year, and t represents the time the money is invested for (in years).

Let’s consider this example. Suppose you have an APR of 5% that is compounded semi-annually. Now if we place values in formula provided above, it would look like this:

APY = (1 + r/n)^n – 1 APY = (1 + 0.05/2)^2 – 1

APY will be 5.06%.

*Higher frequency of compounding will result in higher APY.

Let’s understand this by example. If we change the frequency of compounding in above example by making it compounding daily instead of monthly. The APY will be as follows:

APY = (1 + r/n)^n – 1

APY = (1 + 0.05/365)^365 – 1

Using the given formula, the APY would be approximately 5.13% when compounded daily.

Effect of the Compounding frequency

Albert Einstein once called the compounding effect the “8th wonder of the world.” Those who grasp its potential can benefit greatly, while those who overlook it may miss out on its rewards.

To better understand the compounding effect let’s read this story.

To illustrate the compounding effect, let’s delve into an intriguing story. Imagine a king who, fascinated by chess, invited his creator to play with him. Delighted by the game, the creator was offered a wish by the king. Instead of asking for riches or treasures, the creator humbly requested just one grain of rice placed on the first square of the chessboard, with a doubling effect on each subsequent square. The king and his courtiers chuckled at what seemed like a modest request for a game of chess.

Little did they know that the compounding effect would soon reveal its astonishing power. As the number of squares on the chessboard grew, so did the amount of rice. Eventually, the total weight of rice reached a staggering 461 billion metric tons!

Translating this concept to modern times, the value of this rice would equate to a mind-boggling 300 trillion dollars, surpassing the wealth of the entire world. The once seemingly trivial request turned into an astounding demonstration of the power of compounding.

The key lesson here is that compounding can work wonders when it comes to investments. As interest accrues on previously earned interest, the impact grows exponentially with time. This snowball effect, often referred to as the “Domino effect,” highlights the potential of letting investments grow and compound over an extended period.

In essence, those who harness the power of compounding can reap significant rewards, while those who underestimate its influence may miss out on valuable opportunities. Understanding and leveraging the compounding effect can lead to financial success, making it an essential aspect of prudent financial planning.

FAQ

What is a good APY rate:

A good APY rate varies based on market conditions and the type of investment. Many online banks offer APY rates around 1%, while the national average hovers at 0.05%. When considering investments, aiming for an APY rate of 1% is generally considered favorable.

Frequency of APY Payments:

While APY is the interest earned on an investment in one year, the frequency of payments may vary based on the bank or investor’s policy. Interest can be paid out monthly, semi-annually, quarterly, or yearly, depending on the agreement with the bank.

Can I compare APY rates across different financial institutions?

To compare APY rates effectively, consider exploring websites like NerdWallet, which offer comparisons of high-yield online savings accounts from various financial institutions. Link here

Calculate APY in Excel:

Also checkout this video to learn how to calculate APY in Excel