Table of Contents

What is Return on Investment (ROI)?

ROI also known as return on investment, is a common metric used to evaluate the efficiency of an investment opportunity. It is used on both actual and forecasted returns from an investment.

Purpose of ROI Calculator

ROI calculator permits you to estimate the profit or loss on your investment. Our return on investment calculator can be used to contrast the capability of a few investments. Consequently, when you are going to make a financial decision you will find the ROI formula helpful. If you know how to calculate ROI, it’s easier to anticipate the results of an investment.

Investment opportunities:

Return on Investment, usually abbreviated as ROI in finance, is an ordinary, extensive metric used to assess the foresee profitability on various investments.ROI is a solid base from which to go forth before any serious investment opportunities are even contemplated. The metric can be applied to anything from stocks, real estate, employees, to even a cattle farm; anything that has a cost with the possibility to derive gains from can have an ROI assigned to it. Even, there are many more complex formulas that exist to help calculate the rate of return on investments perfectly, ROI is applauded and still widely used due to its simplicity and extensive usage as a rapid method.

Difference between ROR and ROI:

ROI may be confused with ROR, or rate of return. Sometimes, they can be used interchangeably, but there is a big difference: ROR can denote a period of time, often annually, while ROI doesn’t.

The basic formula for ROI is:

ROI = ( Gain from Investment – Cost of Investment ) / Cost of Investment

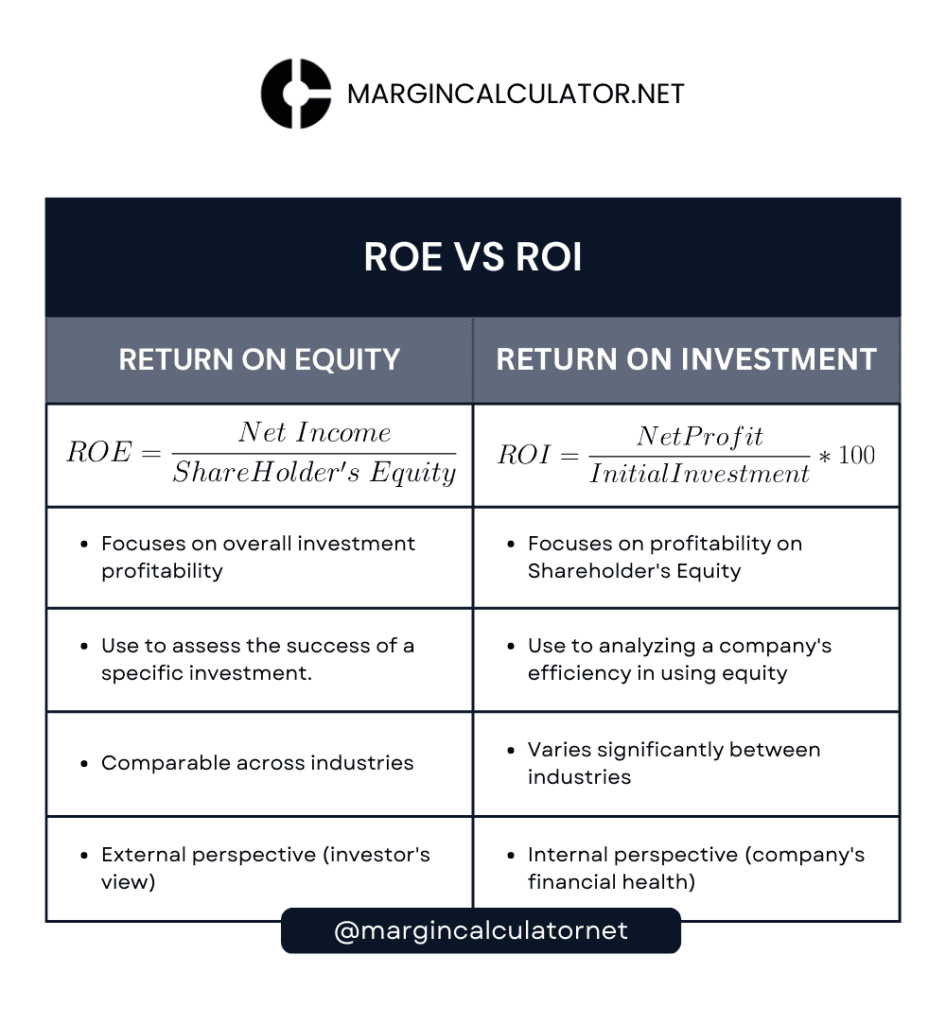

Difference between ROI and ROE:

Example of ROI:

As a basic example, Robert wants to calculate the ROI on his poultry farming operation. From the commencing until the present, he invested a total of $50,000 into the project, and his total profits to date sum up to $80,000.

= ( $80,000 -$ 50,000 ) / $50,000

= 60%

Robert’s ROI on his poultry farming operation is 60%. Conversely, the formula can be used to work out either gain from or cost of investment, given a desired ROI. If Robert wanted an ROI of 60% and knew his initial cost of investment was $50,000, $80,000 is the gain he must make from the initial investment to realize his coveted ROI.

Importance of ROI for Real Estate:

Knowing what the ROI is on any investment, especially real estate, permits investors to be more informed. You may be able to estimate your costs and expenses, as well as your rental income before you buy. This gives you a chance to contrast it to other, similar properties. You can determine how much you will make, once you’ve diminished it down. If at any point, you realize your costs and expenses will increase your ROI, you may have to make a decision about whether you want to ride it out and hope you’ll make a profit again, or whether you should sell your property so you don’t lose out.

Suppose, if you purchase a property in New York for $600,000.As an investor in the real estate market. Three years later, you sell this property for $900,000.

You should use the ROI formula to calculate return on investment.

ROI = ( $1200,000 – $800,000 ) / $800,000

ROI = 0.5

ROI = 50%

So the return on your investment for the property is 50%.

Risk with ROI usage:

It is straightforward to grasp as a call tool. The simplicity of the formula permits users to freely opt for variables, e.g., length of the calculation time, whether or not an overhead price is enclosed, or that factors are wont to calculate financial gain or price constituents. To use ROI as an associate degree indicator for accentuation investment comes is risky since sometimes the ROI figure isn’t labeled together with evidence of its make-up.

For long investments, the necessity for an internet gift price adjustment is nice. the same as Discounted income, a reduced ROI ought to be used instead.

One of greatest risks related to the people’s ROI calculation is that it doesn’t totally “capture the short or long importance, value, or risks corresponding with natural and social capital” as a result of it doesn’t account for the environmental, social and governance performance of a company. while not a metric for mensuration the short- and long environmental, social and governance performance of a firm, decision-makers are coming up with for the long term while not considering the size of the impacts associated with their selections.

What is a good rate of come on investment?

When your cash grows each year, combination interest seems like magic. If you invest $1000 at five-hitter interest, you’ll need $1750 in fifteen years. that is $750 in interest. If instead, you invest at five-hitter annual interest, you’ll need regarding $2079. combined monthly, you’ll need regarding $2114.

The real magic comes after you earn a better rate of come on your investment. rather than finance at five-hitter, what if you’ll invest at 8%? 10%?

Why will this matter? this can be your cash. perhaps you have set it aside for education, retirement, or shopping for a house. that cash is anchorage it buys you freedom.